Are you willing to be tracked to save money on your insurance?

In this day and age we are all trying to control our insurance costs without sacrificing the most important area for having insurance which is your COVERAGE. With many insurance companies marketing being focused solely on the money aspect of insurance they never highlight the fact that “cheaper” is not always better. I have always been taught and found true that you get what you pay for.

However that does not mean that you cannot still find ways to minimize your insurance expenses without any sacrifice in coverage. We all know, or should know that insurance rates are based on numerous factors including your insurance credit score, where you live, your age, and your driving history to name a few.

Well a new type of discount solely based on your driving habits is becoming more popular with each insurance company we represent and I feel this is where the industry is headed in the future for getting the most accurate rate based on your individual driving factors. That new discount is driver habit tracking via a device you plug in to your car or an app you would download and install on your smart phone. I personally did not know how I felt about this when it first came out as it seems like our world is headed towards everything we do being tracked with internet searches, social media, and smart home devises. I felt “why would I want to have an insurance company track my driving as well”. That seemed to be going too far and I originally did not feel I would be willing to do it. But it is going to happen whether I like it or not and I have to come to terms with that, or eliminate all technology from my life (not happening).

After purchasing a new car and seeing the increase in my rates I ran quotes for the tracking discount and with that additional initial discount insurance carrier offered for signing up I was going to offset any insurance increase for having a newer car while keeping my coverage’s the same. That peaked my interest and with myself feeling like my wife and I are good drivers we could potentially benefit being tracked. So I made the leap and my wife and I signed up both of our cars to be tracked and get the insurance savings.

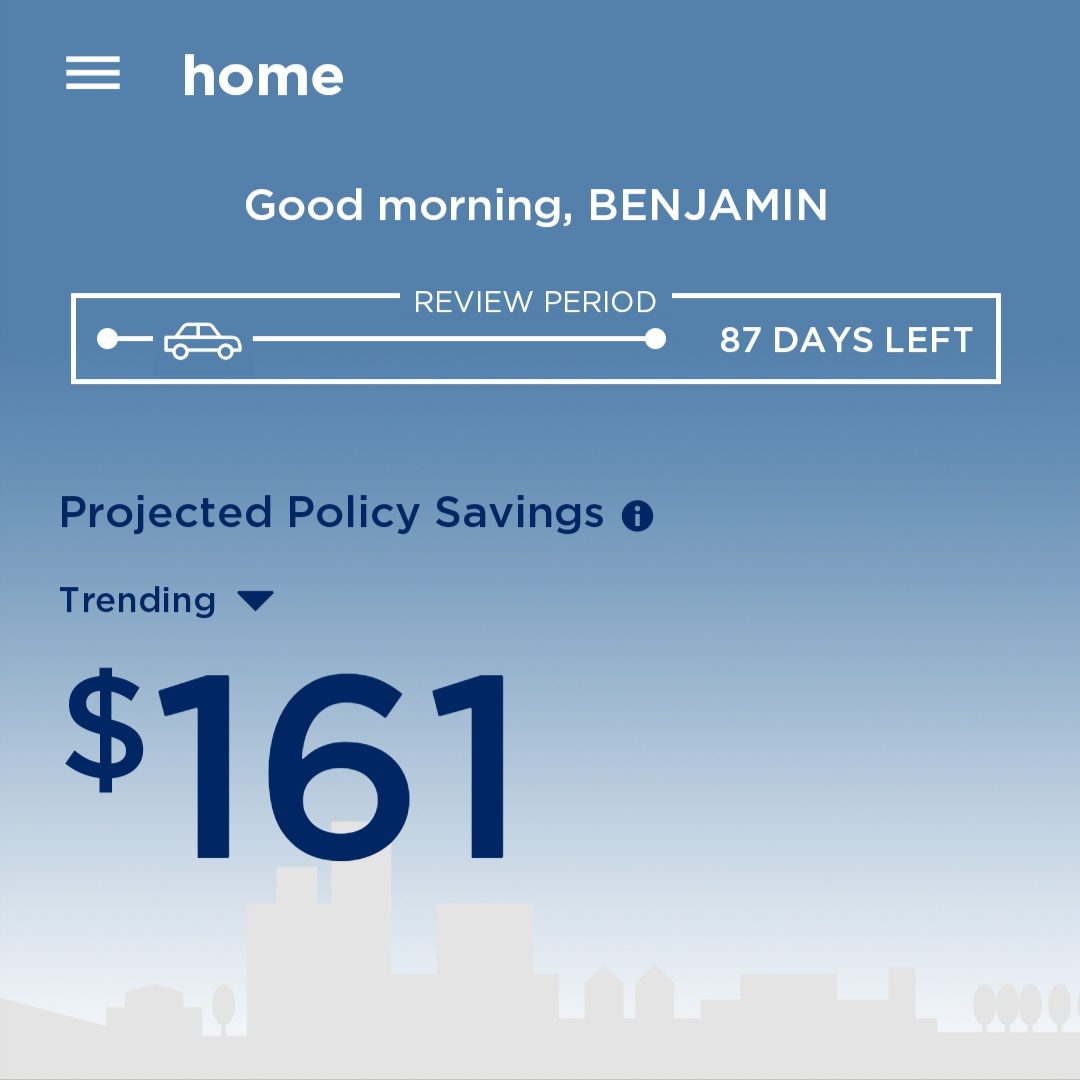

One month into the tracking period I must say that I have changed my tune on how I feel about the tracking and knowing if I want to get the best rate possible based on my specific driving habits it was a good choice for us. The great thing about the phone app is you can track it daily and it gives you constant updates on your driving and insurance savings (see above). So for 90 days of being tracked I can already see I have reduced my overall insurance cost by $161.00 a year and the discount is continuing to increase based on my driving habits so far. This makes me happy!!

The habits that most of the carriers track with these devices are pretty specific – they know how many miles you drive, at what time of day your drive, how many times you slam on the breaks, and how fast you are accelerating. So if you feel you are a good to great driver and want to limit your insurance costs based on your specific habits (WHILE NOT SACRIFICING YOUR COVERAGE) instead of being lumped in with everyone else, then contact us and we can review this option with you.

The Miller Insurance Agency – (877)277-9036

Categories: Blog