How Telematics can help you save on Auto Insurance

Telematics uses wireless technology to monitor and troubleshoot a wide variety of vehicle performance information in real time. It makes possible many common and useful applications you may already be using such as onboard GPS, OnStar, and other security features.

This technology can also help you save on auto insurance by allowing you to prove that you’re a safe, conscientious driver who deserves a discount.

Lower your premiums with RightTrack

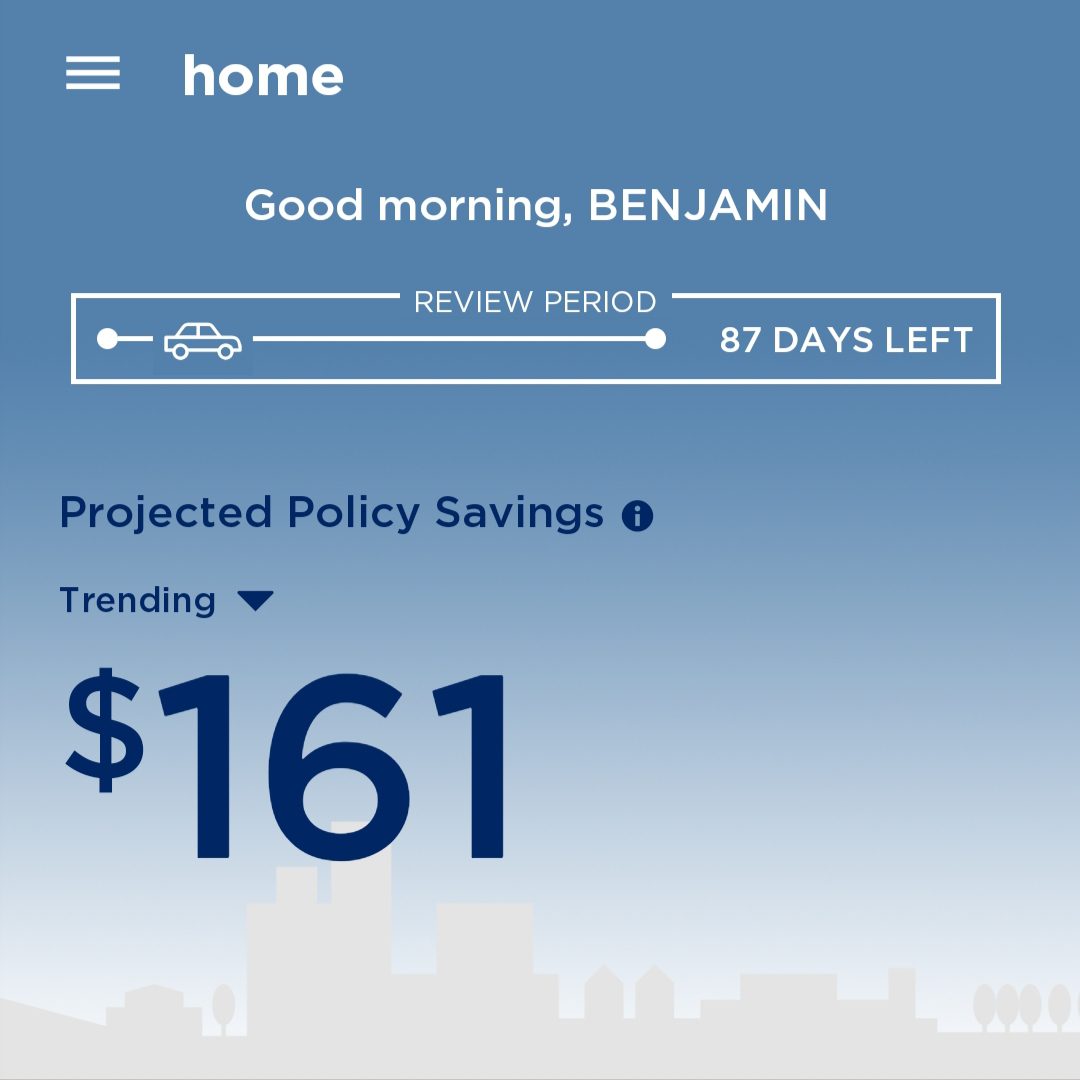

RightTrack, Safeco’s own telematics product, was created to reward you for being a good driver. Depending on where you live, this free program uses a mobile app or a small device that plugs into a port on your car’s dashboard. Either way, the tool is easy to set up, use, and monitor.

Once it’s installed, we then track your driving for just 90 days to assess four factors: braking, acceleration, nighttime driving, and total miles driven. However, it does not track where you drive or record other personal information. To complete the program, all you have to do is drive a minimum of 125 total miles within the 90-day period.

Following the review period, we’ll then rate your driving and immediately offer you a discount just for participating. You’re are guaranteed to save a minimum of 5% on your premiums — and could save up to 30% — and you will never be surcharged for the driving behaviors monitored during your participation in RightTrack. Plus, this savings applies for the life of your policy, so there’s no need to track your driving again in the future. Think of it as a permanent discount you earned for having good driving habits.

So put yourself in control of your policy savings and enroll today. For more information, contact your local independent Safeco agent or learn more about RightTrack program options in your state.

Source: Safeco Insurance

Categories: Blog