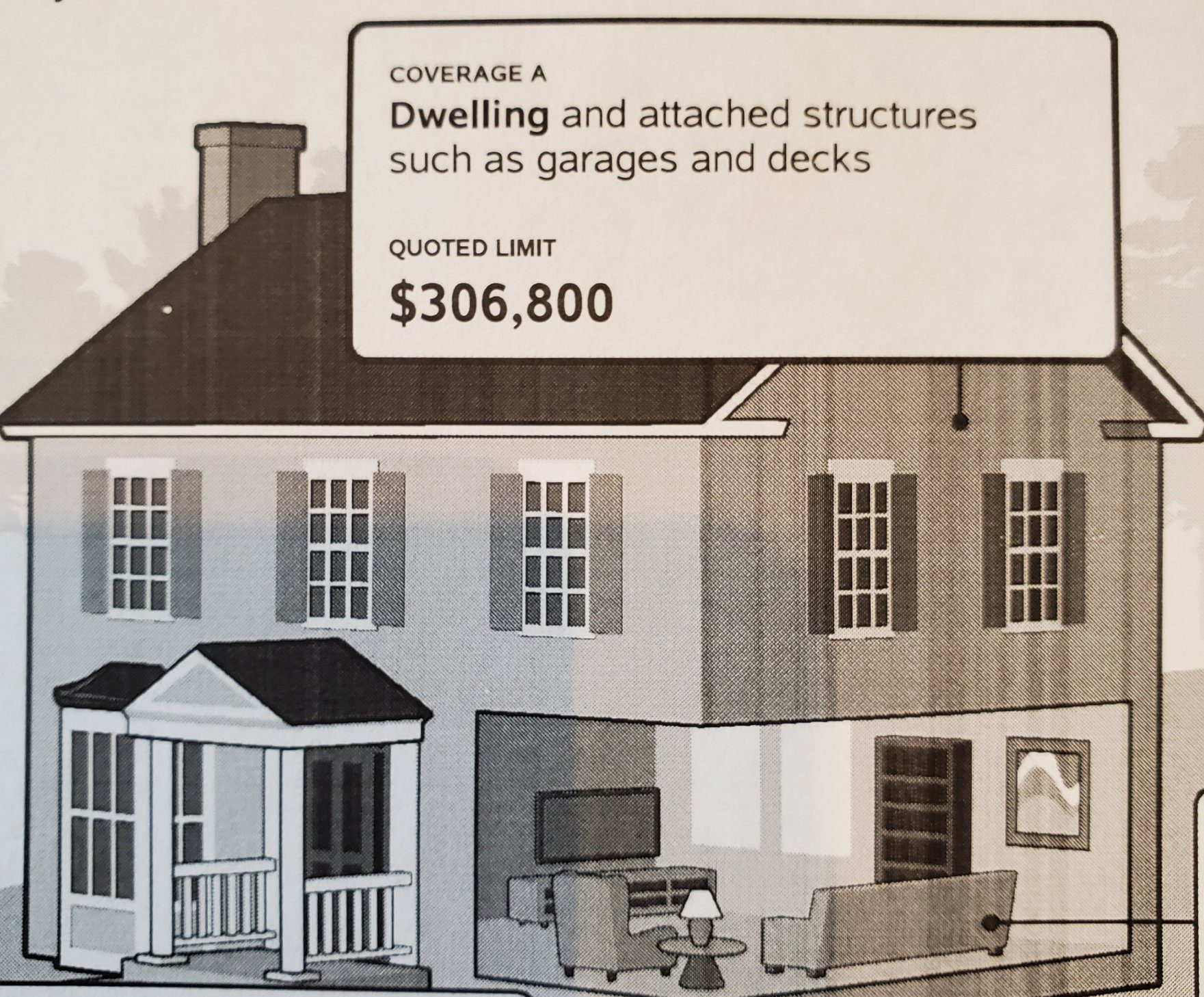

Back to Basics-Homeowners Insurance explained: Dwelling Coverage

This coverage, typically listed 1st on your policy lists how much your home is insured for with it’s attached items if there were a covered loss.

This amount is determined by a replacement cost estimate; taking into account the size, style, and finish of your home.

Your dwelling coverage typically equals or may be slightly greater than this replacement cost estimate, but cannot be lower than this amount.

I recommend you review this estimate with your agent every 5 years or after home improvements or renovations.

Most home policies also include extended replacement cost, which would be the amount above the dwelling coverage the carrier would pay out in the event of a catastrophic loss. This extended coverage is usually 20% or 25%, but higher amounts may be included or selected.

This amount also includes the cost of debris removal should a loss occur.

Losses typically covered are:

weather events, fire, and theft or vandalism

Losses NOT covered:

Flood, Earthquake, and home maintenance.

Again please review the replacement cost estimate with your agent, this is the most often item on a home policy that is incorrect. If you have any questions, give me a call.

Source: Gretchen’s Weekly Wednesday Insurance Tip

Categories: Blog